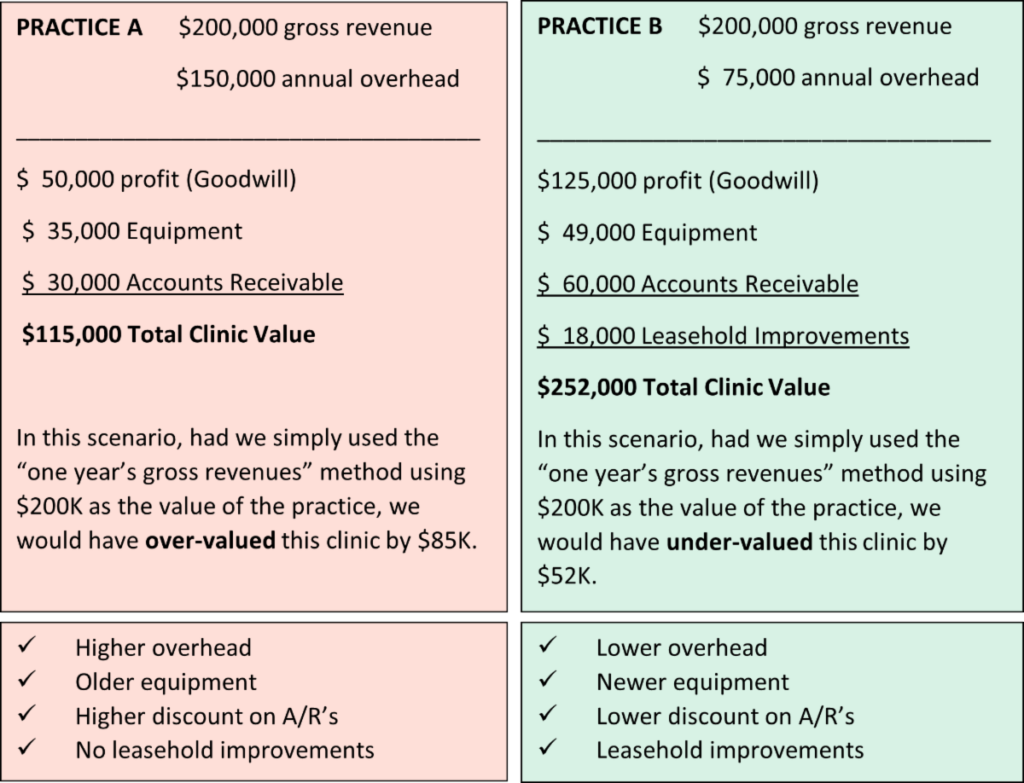

The biggest challenge that many chiropractors have in answering this question is obtaining a concise method of evaluation. In the past, doctors of chiropractic have been using a method of valuing their practice by equating their practice value with one year’s gross revenues. This included patient files (goodwill), equipment, and accounts receivable (A/R). If there was any real estate, that would be added on to the value. If I had a practice that had gross revenues last year of $150,000, that meant that you could buy my practice for $150K plus real estate, if applicable. This “cookbook” method was accurate some of the time and potentially very inaccurate at other times.

The problem I have with this method can best be demonstrated with an example of two clinics (A & B). Both clinics had gross revenues last year of $150K. Let’s say that practice A has annual overhead of $120K and practice B has annual overhead of $50K. Therefore, practice A had an annual profit of $30K and practice B had annual profits of $100K. The difference in profit would impact the value. A second concern is equipment.

Practice A is fully equipped, but all the items are at least 20 years old. Practice B is also fully equipped, but the average age of the items is three years. This is another substantial difference in value.

Because there is such variability from practice to practice, an accurate, repeatable method of valuation needs to be established. The best method to use is to break down the value of the practice into four separate components, determine their current values, and add them together. The four components are: Goodwill, Equipment, Accounts Receivable (A/R), and Real Estate.

- Goodwill: This is sometimes referred to as “patient files.” However, it is much more than just patient files. The goodwill value reflects the financial condition and current income generation of the practice. In other words, “What was last year’s profit?” To make this procedure even more accurate, overhead expenses are divided into two categories: pertinent and elective. Pertinent expenses are necessary expenses for business operation, such as rent, telephone, utilities, office supplies, C.A. salaries, business liability insurance, etc. Elective expenses are expenses that are not necessary to run the business. The goodwill value is equal to annual collections minus “pertinent” expenses.

- Equipment: The value of equipment can be determined in many ways. For instance, there is replacement value. This is normally used when you have an insurance policy that will replace an item in the event of a fire or if the item is lost or stolen. This value is very high and only takes into consideration the replacement cost. Another value is depreciated value.

- This value is usually used for tax purposes. At any point in time, this value has a tendency to be less than the actual value of the item. To most accurately reflect the value of the items in your practice, I would suggest that a Fair Market Value (FMV) schedule be created. FMV takes into account the age, condition, purchase price, and type of equipment that is being evaluated. It also will provide for adjustments due to obsolescence and other market factors.

- Accounts Receivable (A/R): Getting an accurate value of A/R can be a tricky matter. The first question that needs to be asked is, “Have the accounts been purged on a regular basis and when was the last time this took place?” There are many factors that have an impact on the value of the A/R. Things to be considered include: historical collection rate, time value of money, cost of collections, inherent risk, type of account (i.e., Work Comp, PI, cash, Medicare) and the specific age of the account. Because there is such a large variation of these factors from practice to practice, when I am in the process of performing an evaluation, I need to develop a custom-made discount chart for the individual practice.

- Real Estate: If there is any real estate involved in the sale of the practice, I recommend that a qualified real estate appraisal be used to determine the value.

Let’s look at the following example to illustrate how utilizing a “one year’s gross revenues” valuation method can under or over value a clinic:

So, the next time someone asks you the value of your practice, rather than saying it is worth one year’s gross revenues, now you can say it has a value equal to one year’s collections minus pertinent expenses, plus the fair market value of the equipment, plus the present value of the accounts receivable, plus the real estate. Unfortunately, you may not be able to say all of that in one breath.

If you would like to learn more about the valuation process, please give us a call or send us a message!